A Decemeber 2024 report by Kaiko and Bitvavo has highlighted the significant growth of Markets in Crypto-Assets Regulation (MiCA)- compliant stablecoins in the European Union (EU).

Is MiCA successfully reshaping the regulatory landscape for digital assets? The European cryptocurrency market has experienced a transformative year in 2024, driven by increased euro-denominated trading volumes and the rise of MiCA-compliant stablecoins.

Meanwhile, Bitvavo and Kraken remained the largest cryptocurrency exchanges for euro trading by volume.

Explore: Quantoz Debuts Two Stablecoins EURQ and USDQ: Tether, Kraken, Fabric Ventures Back Launch

BTC-EUR Trading Pair Played A Pivotal Role

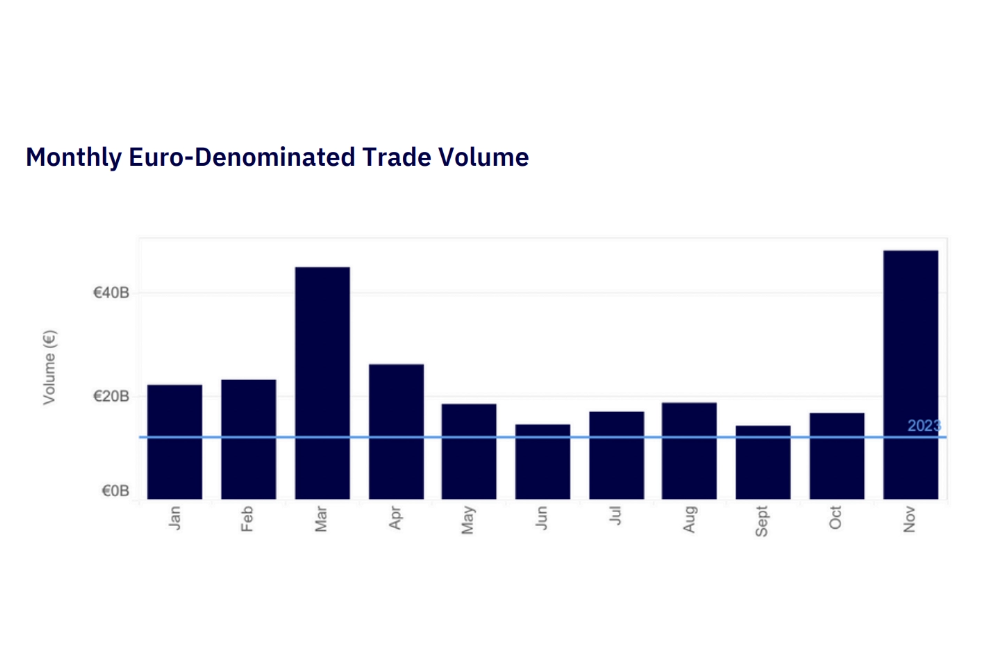

Throughout 2024, euro-denominated trading volumes consistently surpassed the average levels of 2023, reflecting growing demand for euro-based cryptocurrency transactions.

Importantly, monthly euro trade volumes peaked at over €50 billion in November, more than doubling October’s levels.

This surge was fueled by Bitcoin’s record-breaking price highs and increased institutional adoption across Europe.

Furthermore, the euro has solidified its position as the third most-traded fiat currency in global crypto markets. It accounts for 7.5% of fiat-based trading volume, trailing only the US dollar (49.9%) and the Korean won (33.4%).

The BTC-EUR trading pair played a pivotal role in this growth. Its share of global Bitcoin-to-fiat volume climbed from 3.6% to nearly 10% over the year. This trend underscores the euro’s increasing prominence as a preferred currency for cryptocurrency transactions.

Is MiCA A Game-Changer For Stablecoins?

The introduction of MiCA has been a turning point for stablecoins in Europe. The regulation, which began rolling out on 30 June 2024, with full implementation expected by 30 December 2024, establishes clear compliance standards for asset-referenced tokens (ARTs) and electronic money tokens (EMTs).

These rules aim to enhance consumer protection, improve market integrity, and foster innovation within the EU.

MiCA-compliant stablecoins have quickly captured a dominant share of the European market.

Notably, Tether announced in November that it would discontinue support for its euro-pegged stablecoin EURT across all blockchains.

The decision was attributed to Europe’s evolving regulatory frameworks under MiCA and Tether’s strategic shift toward other initiatives.

Once a dominant player in the euro-stablecoin market, EURT saw its supply drop significantly from its peak market capitalization of $500 million to just $27 million by late 2024.

Explore: Singapore’s Dtcpay Decides To Embrace Stablecoins, Phase Out Bitcoin, Ethereum

The post MiCA-Compliant Stablecoins Dominate European Market. BTC-EUR Trading Pair Flourishes! appeared first on 99Bitcoins.

Source link

#MiCACompliant #Stablecoins #Dominate #European #Market #BTCEUR #Trading #Pair #Flourishes