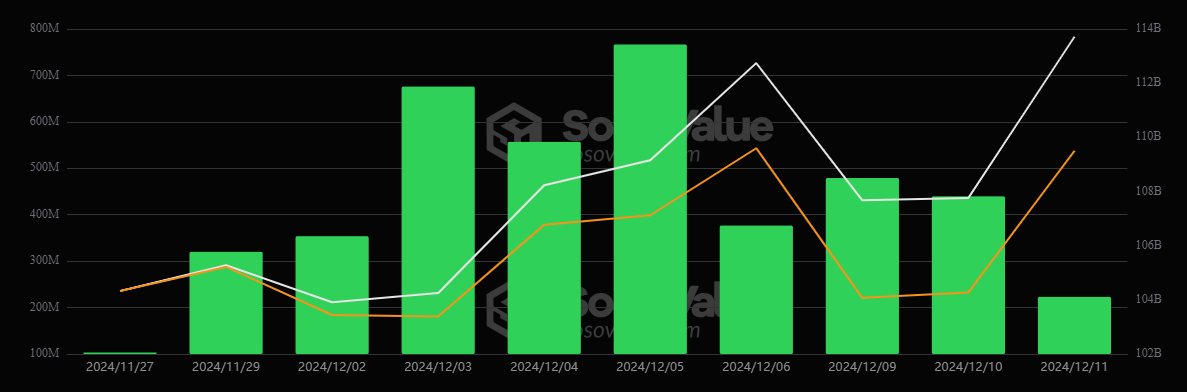

Ethereum and Bitcoin ETFs are stealing the show, with weeks of strong inflows signaling a clear surge in investor appetite. Institutional players are jumping in, and retail investors are diversifying their bets, pushing this segment into the spotlight.

Leading the charge, Bitcoin spot ETFs have racked up a 10-day streak of inflows, pulling in $223 million on December 11 alone. Fidelity’s Bitcoin ETF (FBTC) carried much of the load, throwing down $122 million on Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

in a single day.

Bitcoin ETFs Lead With Steady Momentum

iShares Bitcoin Trust (IBIT) has emerged as the dominant player, managing $51.1 billion in assets. Fidelity’s FBTC follows closely, with $20 billion under management. Both ETFs have posted a robust 138% growth since February, far outpacing the broader market index.

“We believe many advisors and investors utilize Bitcoin ETFs for a small portion of their portfolios, leveraging them in a risk-on capacity,” said Todd Rosenbluth, research head at TMX VettaFi.

EXPLORE: Buying and Using Bitcoin Anonymously / Without ID

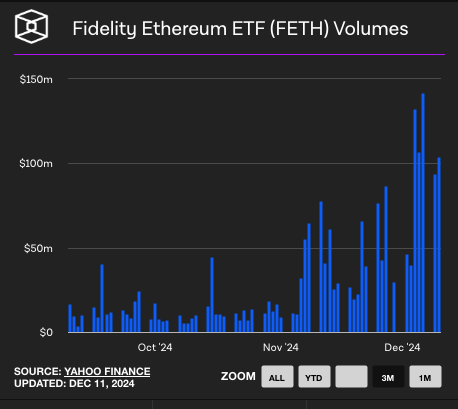

Ethereum ETFs Join the Rally

Not to be outdone, Ethereum-focused ETFs have enjoyed their own inflow streaks, with 13 consecutive days of positive net flows. Over this period, $1.95 billion has poured into Ethereum ETFs, raising their net assets to $13.18 billion.

Blackrock’s Ethereum ETF (ETHA) led on December 11, bringing in $74.1 million. Such consistent inflows demonstrate the increasing institutional acceptance of Ethereum as a core asset class alongside Bitcoin. Ethereum ETFs now account for 2.86% of the cryptocurrency’s global market capitalization, solidifying their growing market relevance.

The differences between spot and futures-based ETFs remain critical to this market shift. Spot ETFs, favored for their direct tracking of cryptocurrency prices, have delivered higher returns, with top performers like FBTC and IBIT up 138% since February.

Futures ETFs like ProShares’ BITO, meanwhile, flash an eye-catching 52.3% yield thanks to tax tricks, but there’s a slight hitch with its two-year performance stalling at 28% ROI, leaving spot ETFs looking like the smarter pick for the long haul.

“Futures-based ETFs were initially the go-to option, but investor preference has shifted towards spot ETFs, which better track actual market performance,” Rosenbluth added.

Market Implications and Growing Adoption For Bitcoin ETFs

Bitcoin and Ethereum ETFs have earned over $6 billion in recent weeks, shifting gears in the crypto market and capturing institutional focus. These funds aren’t just about diversification anymore—they’re evolving into revenue powerhouses. Take WisdomTree’s BTCW ETF, which has earned a staggering 95% of the firm’s revenue, cementing ETFs as the go-to solution for asset managers looking to thrive.

The continuous growth in ETF inflows for Bitcoin and Ethereum underscores their maturing role in global financial systems. Investors are monitoring whether these trends will translate into sustainable price increases and broader adoption in mainstream financial portfolios.

All eyes are on whether these inflows will drive further innovation in this rapidly growing investment category.

EXPLORE: 17 Best Crypto to Buy Now in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Ethereum and Bitcoin ETFs See Record-Breaking Inflows appeared first on 99Bitcoins.

Source link

#Ethereum #Bitcoin #ETFs #RecordBreaking #Inflows